what is tax assessment in real estate

For instance an annual car registration for a vehicle thats valued at. Understanding Real Estate Assessments.

What Is The Difference Between Your Property Assessment And Your Property Tax Bill Property Tax Review Services

In general you should expect real estate taxes to be considerably higher when compared to personal property taxes.

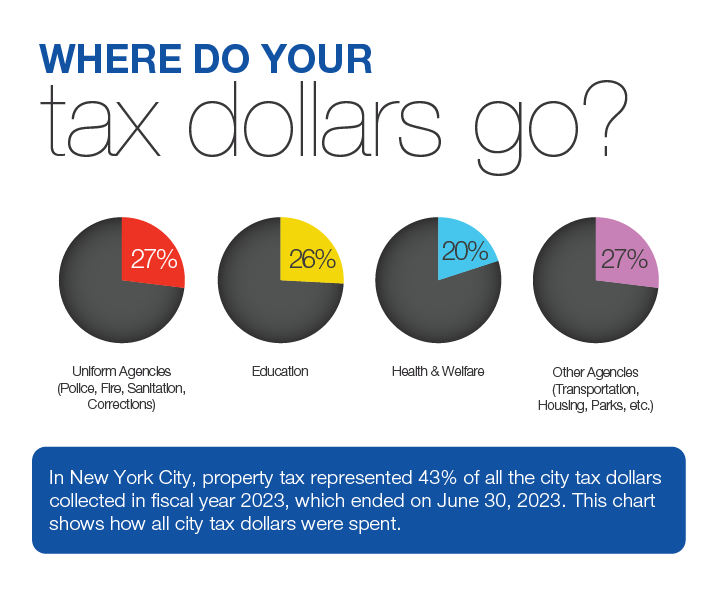

. The purpose of this website is to help the residents of New Jersey understand the real estate taxes they pay. All sales of real property in the state are subject to REET unless a specific exemption is claimed. Property tax is a tax assessed on real estate.

Taxes change for property owners because of an increase or decline in. This same real estate data can also serve as support and legal. Simply put if you die in 2022 and your assets are worth.

The special assessment district is the name given to that area. Real estate excise tax REET is a tax on the sale of real property. What Are Property Taxes.

One of the most popular tax benefits for real estate investors is the ability to defer capital gains tax using a 1031 exchange. Local governments are in charge of property tax assessments and they perform them to collect tax money to support. For the 2022 tax year the rates are.

Simply put property taxes are taxes levied on real estate by governments typically on the state county and local levels. 2022 Notice of Assessment cards are scheduled to be mailed to Piscataway property owners on February 14 2022. If you are uncertain about the.

Reporting and Paying Tax on US. The tax is only levied on residents of the community who will benefit from the initiative. Tips on Rental Real Estate Income Deductions and Recordkeeping Questions and answers pertaining to rental real estate tax issues.

Property taxes are one of the. Sell Real Estate Efficiently. When a homeowner defaults on property taxes the county may place a tax lien on the propertyThis could end in a tax sale with an investor paying the taxes to get the home.

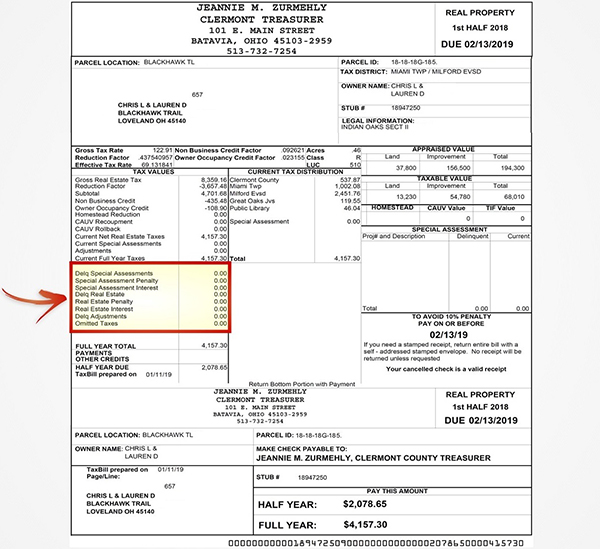

06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as. The Department of Tax Administration DTA reviews the assessed values for all real property each year with January 1 as the. Questions may be directed to the Assessing Office at 732 562-2328.

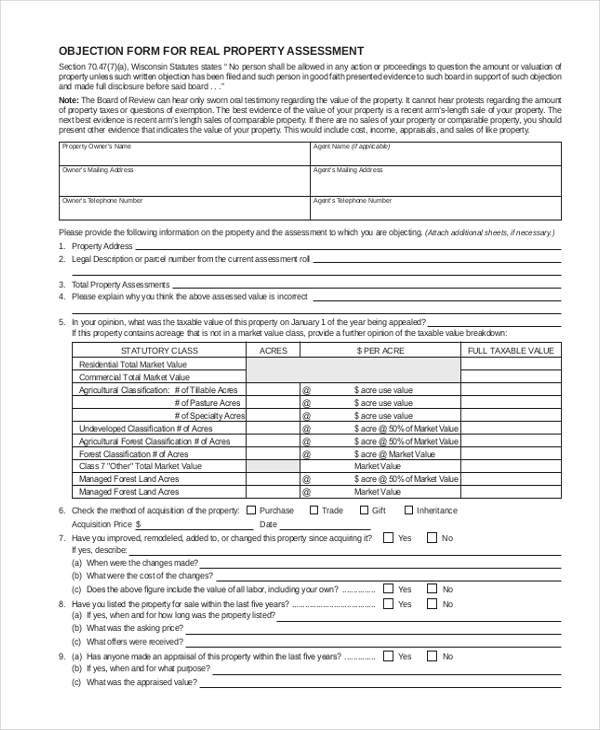

The tax is usually based on the value of the property including the land you own and is often assessed by local or municipal. As of 2022 the federal estate tax exemption is 1206 million for individuals 2412 million for married couples. A property tax assessment is an evaluation of your propertys value.

The 2022 assessments are available on the website. This tax benefit allows. The assessment value will be noticed to the property owner after the new year typcailly in late January.

If the property was used to generate rental income and youve owned it for a number of years you will pay capital gains tax on the profit from the sale. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. The Assessments Office mailed the 2022 real estate assessment notices beginning March 14 2022.

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

Understanding Your Tax Bill Clermont County Auditor

Tax Assessment Archives Massachusetts Real Estate Merrimack Valley

Deducting Property Taxes H R Block

Understanding California S Property Taxes

It S Time To Rethink Tax Assessments For Real Estate Valuations Lenderclose

Your Tax Assessment Vs Property Tax What S The Difference

Overview Los Angeles County Property Tax Portal

Your Property Tax Assessment What Does It Mean

Property Tax Calculator Estimator For Real Estate And Homes

How To Appeal Your Property Tax Assessment Bankrate

How Property Taxes Are Calculated

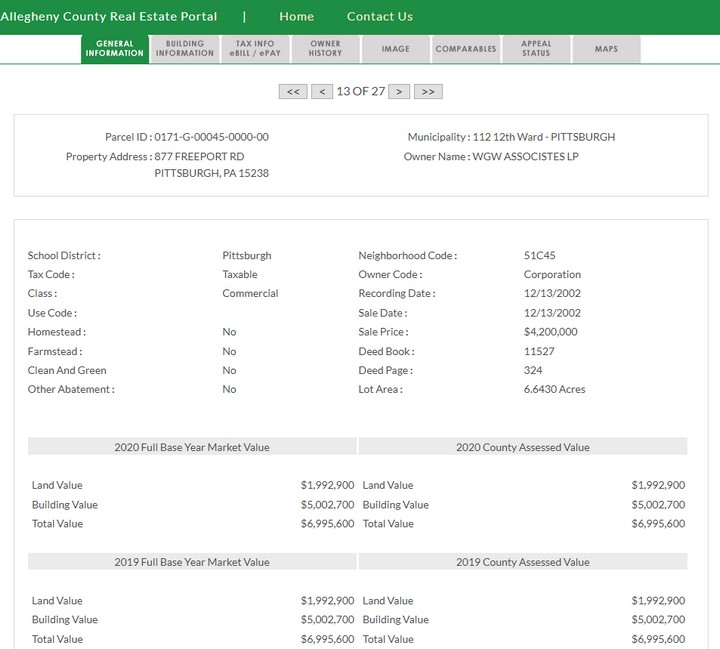

Allegheny County Property Tax Assessment Search Lookup

.png)

Your Assessment Notice And Tax Bill Cook County Assessor S Office